lincoln ne sales tax increase

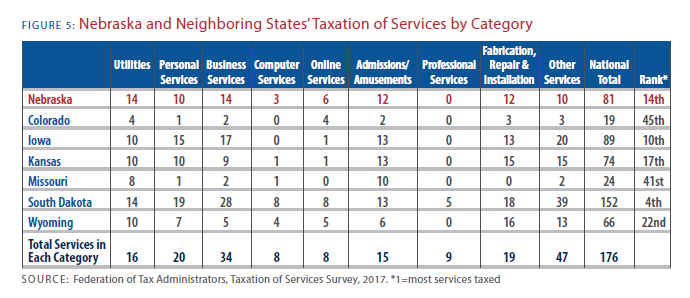

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate. This is the total of state county and city sales tax rates.

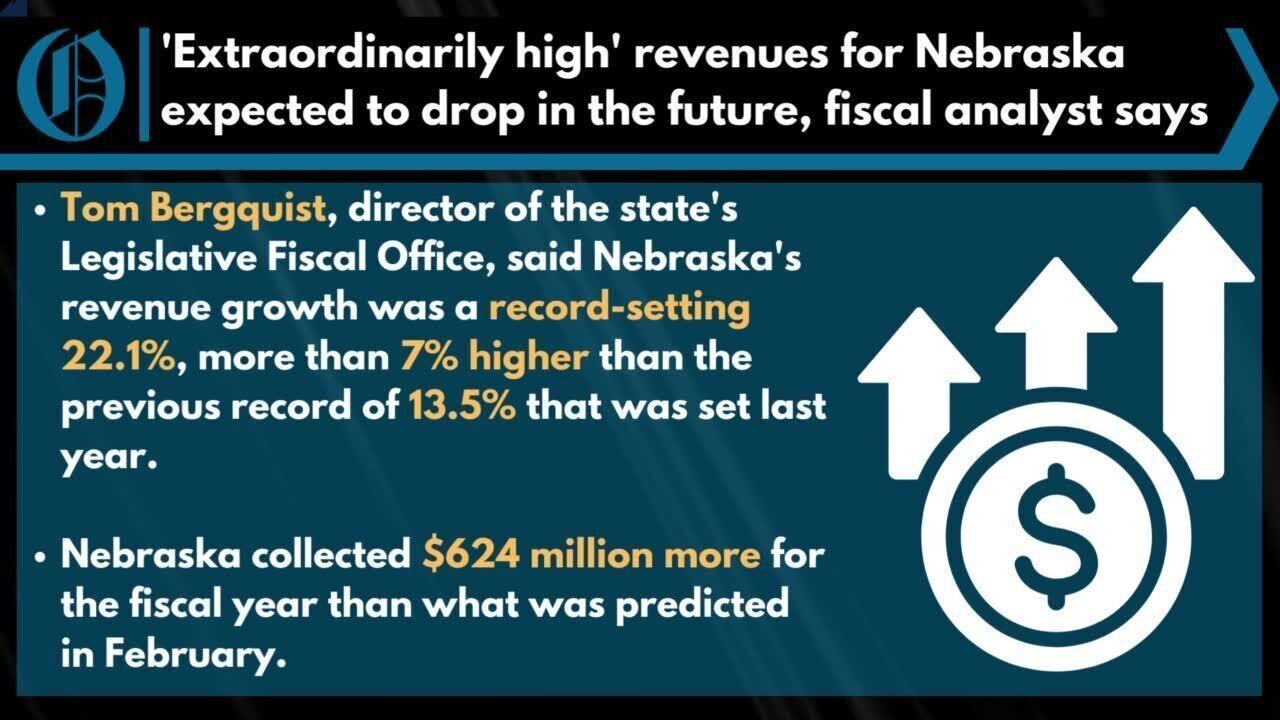

Extraordinarily High Revenues For Nebraska Expected To Drop Fiscal Analyst Says

The Nebraska sales tax rate is currently.

. 025 lower than the maximum sales tax in NE. You can print a 725 sales tax table here. Lincoln Ne Sales Tax Increase.

The group is asking the City Council to place on the April 9 primary ballot a measure to raise the City sales tax one-quarter cent for six years starting October 1 2019. It was approved. Revenue will be generated from the increase starting October 1 and once in place will bump up Lincolns.

Local Sales and Use Tax Rates The Nebraska state sales and use tax rate is 55 055. A yes vote was a vote in favor of authorizing the. Essex Ct Pizza Restaurants.

Lincolns City sales and use tax rate increase In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public. The lincoln city council still has to vote on whether to ask voters to raise the sales tax to 175 percent. The current state sales and use tax rate is.

Nearly 50000 voters marked the ballot question passing it by a slim 650-vote margin. Lincoln County NE currently has 1041 tax liens available as of February 24. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to.

The City of Lincoln today reminded residents that Lincolns sales and use tax rate will increase from 15 percent t o 175 percent beginning October 1. A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Lincoln The City of Lincoln will increase its local sales and use tax rate to 175 effective Oct according to a release from Nebraska Tax Commissioner Tony Fulton.

The December 2020 total local sales tax rate was also 7250. The sales tax increase. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

There is no applicable county tax or. The current state sales and use tax rate is 55 percent so the total sales and. In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public.

Lincoln voters approved a limited sales tax increase Tuesday that would raise 345 million to replace the citys aging emergency radio system and build four new. The minimum combined 2022 sales tax rate for Lincoln Nebraska is. Lincoln ne sales tax increase.

You can print a 725 sales tax table here. NE Sales Tax Rate. 2022 Nebraska Sales Tax Changes Over the past year there have been 22 local sales tax rate changes in Nebraska.

The current state sales. Lincoln NE Sales Tax Rate The current total local sales tax rate in Lincoln NE is 7250. This table lists each changed tax jurisdiction the amount of the change.

Extraordinarily High Revenues For Nebraska Expected To Drop Fiscal Analyst Says

Sales Tax Increase Could Generate 78 Million For Lincoln Streets Kfor Fm 103 3 1240 Am

Avatax Sales Tax Calculation Software Avalara

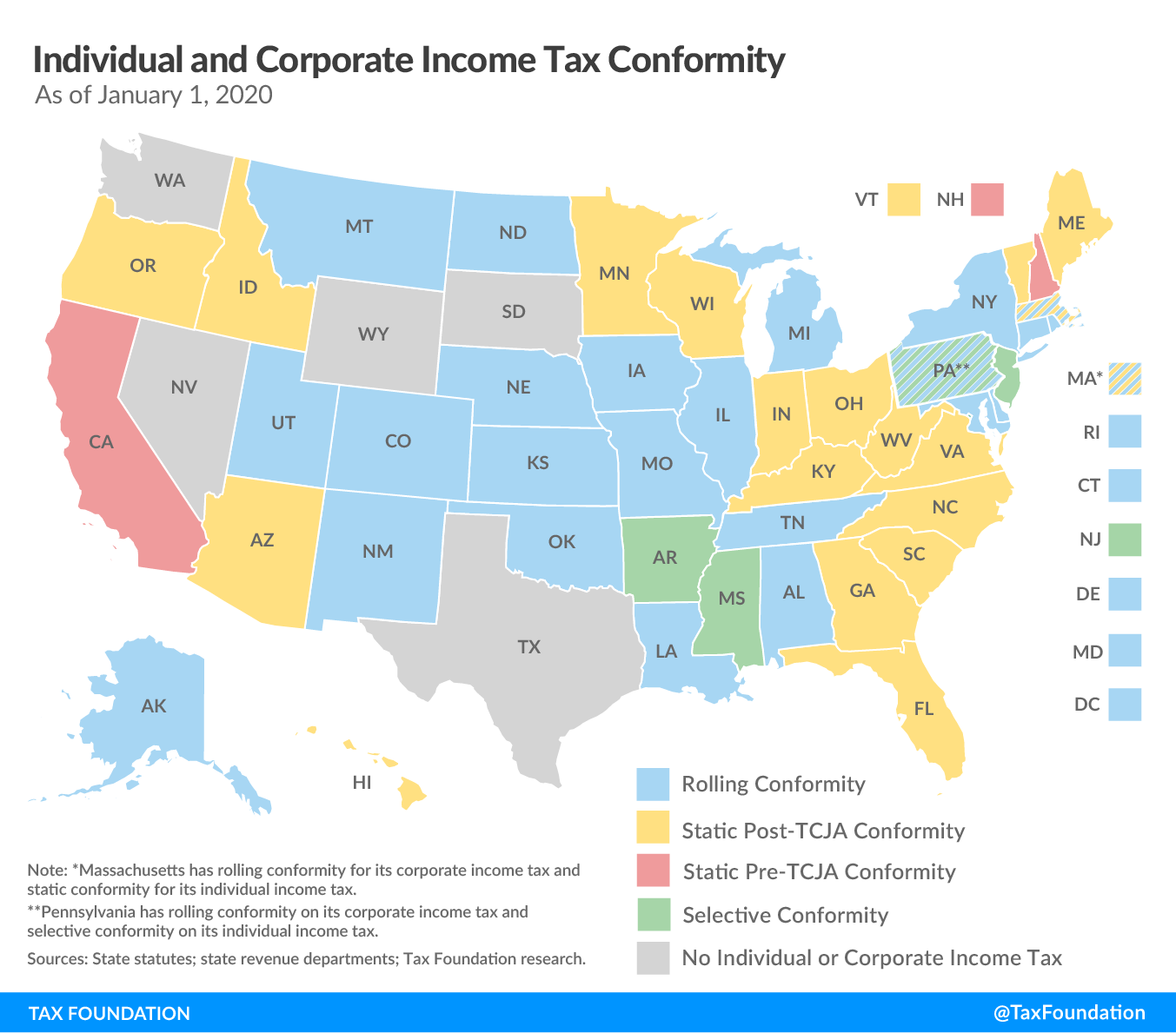

A Twenty First Century Tax Code For Nebraska Tax Foundation

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

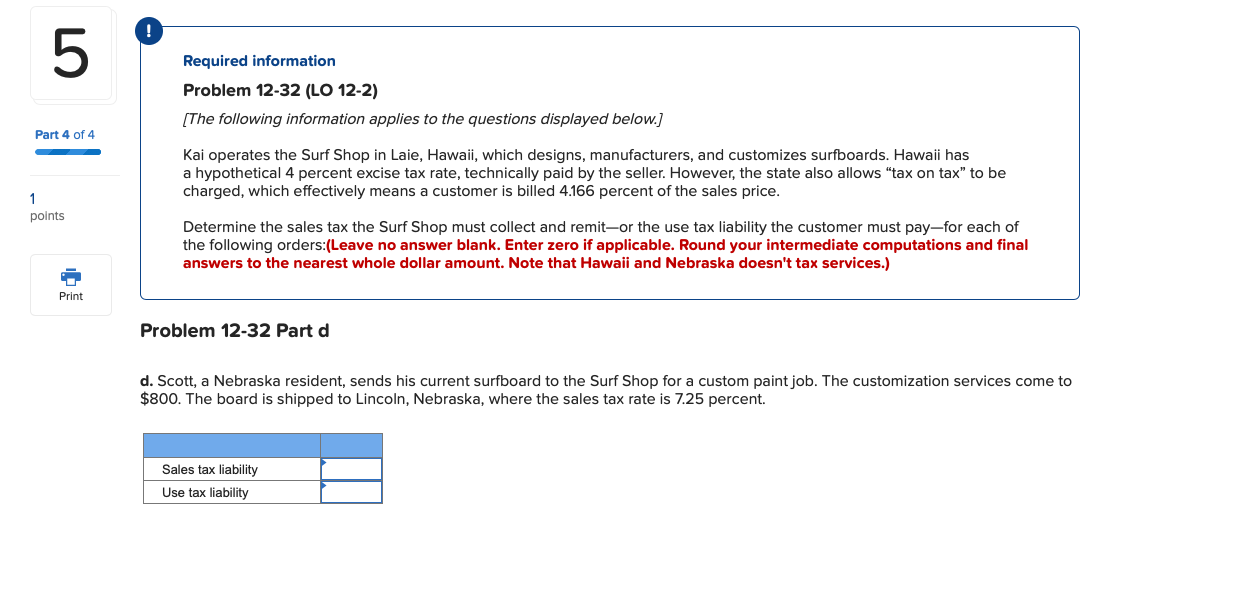

Solved Required Information Problem 12 32 Lo 12 2 The Chegg Com

Sales Tax Increase Could Generate 78 Million For Lincoln Streets Kfor Fm 103 3 1240 Am

State And Local Sales Tax Rates 2019 Tax Foundation

More Businesses May Close If Nebraska Rejects Cares Act Tax Changes

Bottle Racket Illinois High Alcohol Taxes Blow Up Cost Of Independence Day Celebrations

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Get Real About Property Taxes 2nd Edition

Extraordinarily High Revenues For Nebraska Expected To Drop Fiscal Analyst Says

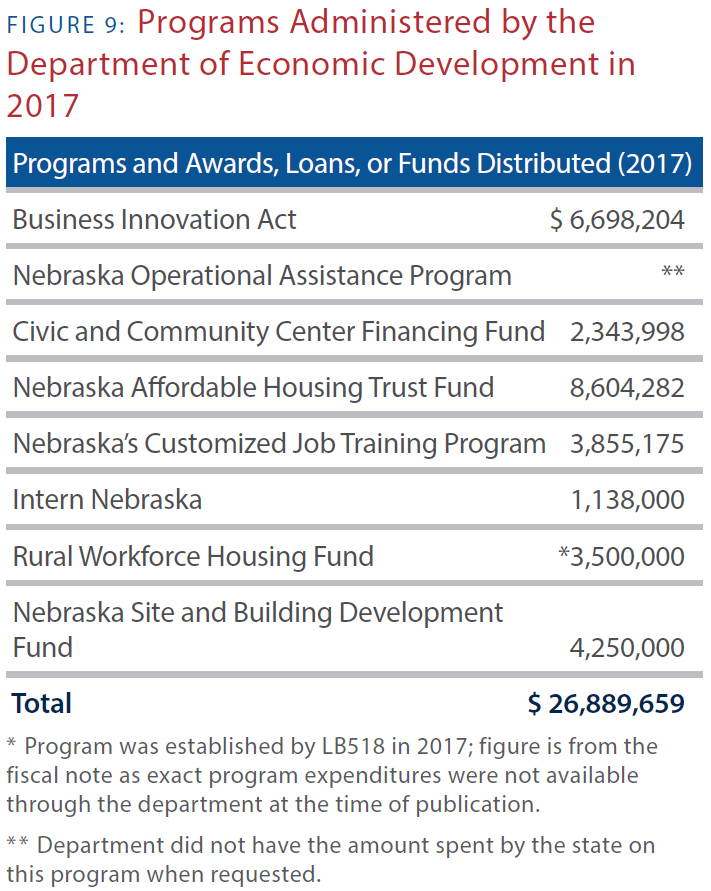

Taxes And Spending In Nebraska

Extraordinarily High Revenues For Nebraska Expected To Drop Fiscal Analyst Says

Get The Facts On Responsible Tax Reform Office Of Governor Pete Ricketts

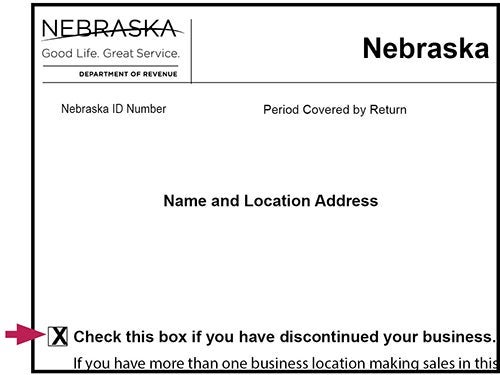

Closing Your Business In Nebraska Nebraska Department Of Revenue